[1] Information Spillover Across Credit Products [SSRN]

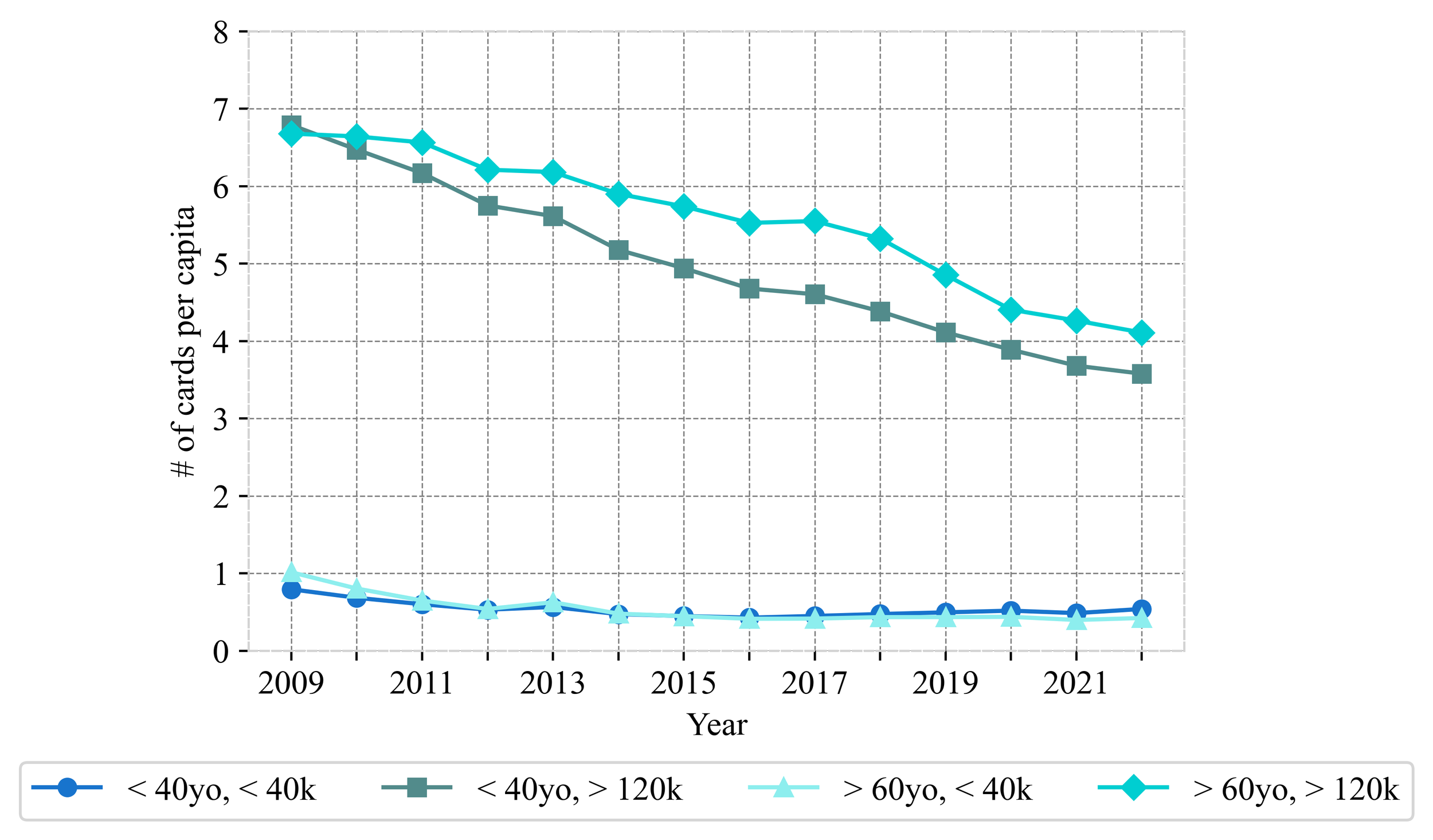

Abstract: I examine how the economies of scale in credit card lending affect mortgage lending via the spillover of information gathered from credit card operations. I find that a one standard deviation increase in the number of credit cards per capita increases mortgage origination by 10.2% and decreases interest rates by 16.6 bps. I show that the increase in the supply of mortgage loans is unlikely to be driven by an inflow of retail deposits or a change in mortgage market power. Additionally, I find that the reduction in interest rate is about three times as large for borrowers who have existing credit cards with their mortgage lenders than those who do not. Collectively, my results are consistent with the hypothesis that information gathered from credit card operations reduces the uncertainty faced by lenders and thereby increases the supply of credit in the mortgage market.

Presentations: 2024 Annual Mid-Atlantic Research Conference, University of Illinois at Urbana-Champaign

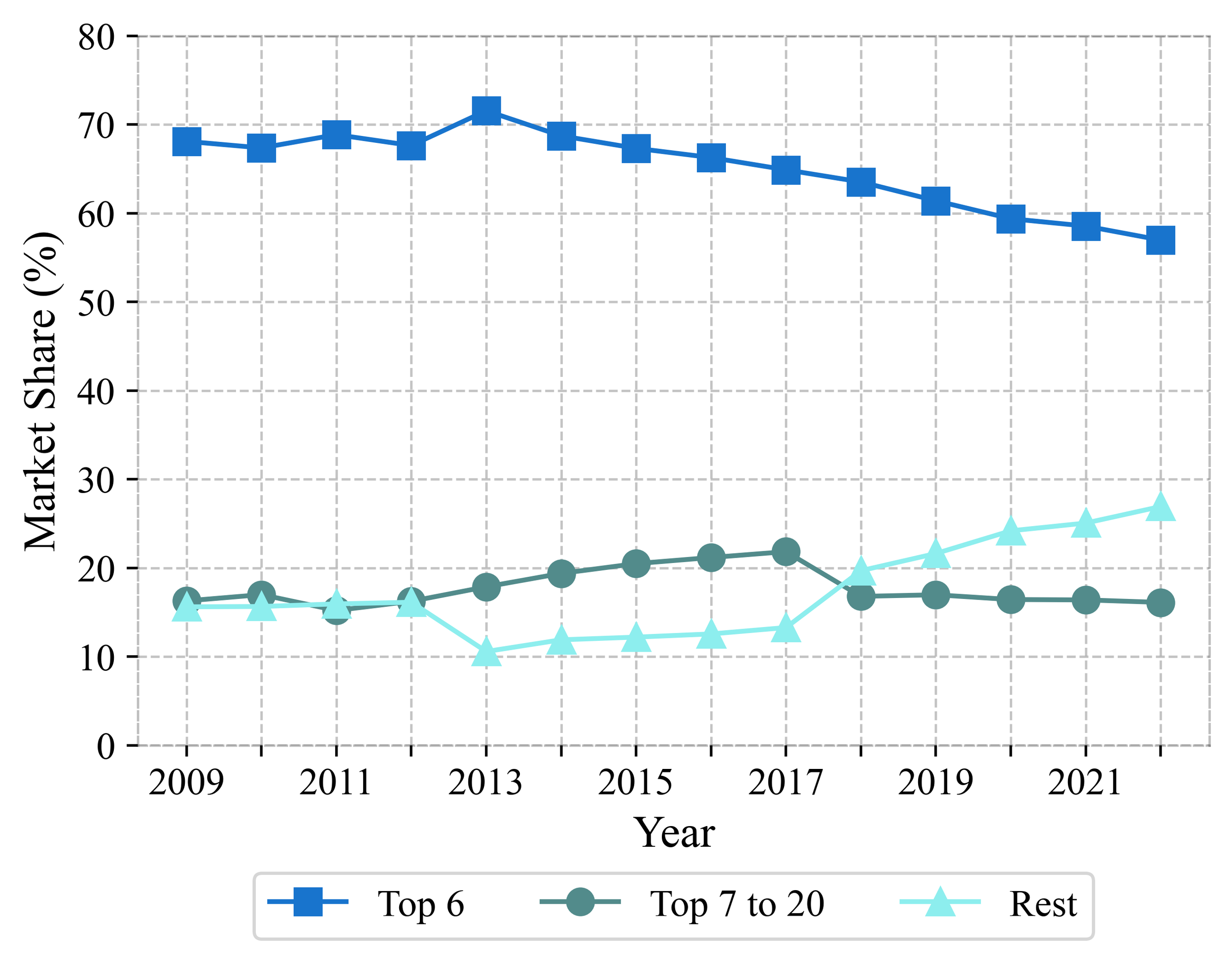

Highlight: I leverage a structural shift in the credit card market in my identification strategy: the market share of the top 6 credit card issuers has been on a consistent declining trend after 2009.

[2] The Edge of Banks is Still Sharp: Pricing Power in the Local Conforming Mortgage Markets, with George Pennacchi

[SSRN] New Draft Coming

Abstract: Contrary to the prevalent perception that the conforming mortgage market is intensely competitive and homogeneous, I find that this market is segmented. Using a novel loan-level micro-data provided by Experian, I show that the lenders that offer higher provision of service impose a premium of about 10 to 20 bps for mortgages with comparable ex-ante risk attributes. Using the magnitude of the premium as a measure of market segmentation, I show that the market segmentation is stronger in markets with higher levels of concentration, in markets where borrowers have a stronger preference for in-person service, and when the local market receives plausibly exogenous increases in mortgage demand. Overall, my findings suggest that service provision enables banks to have pricing power by attracting less price-sensitive borrowers.

Presentations: 2024 American Finance Association Poster Session, 2023 FDIC Bank Research Conference, CES North American Conference, Western Business & Management Conference, University of Illinois at Urbana-Champaign

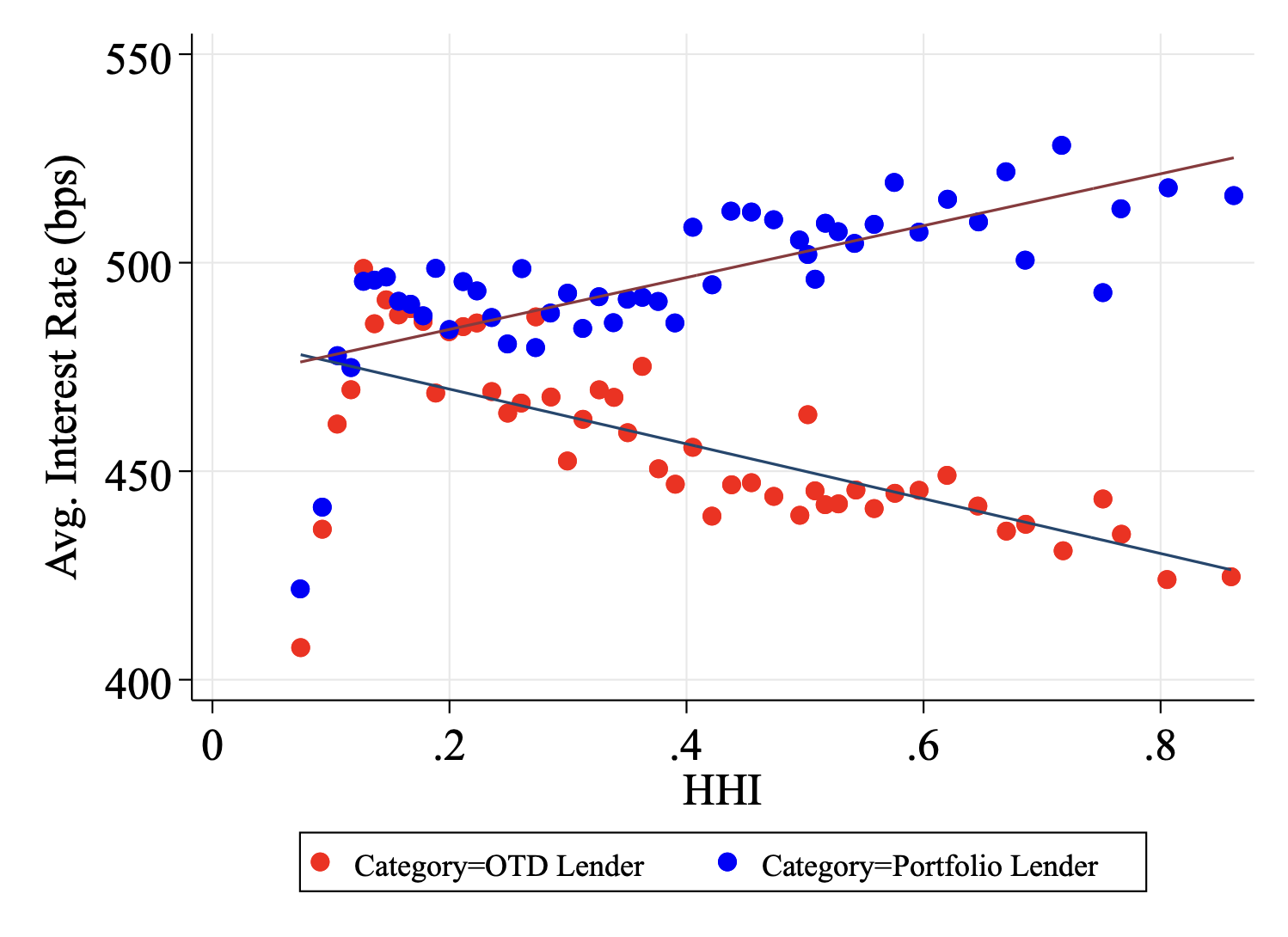

Highlight: While county-level mortgage rates are not associated with the levels of market concentrations (LHS figure), the wedge between the interest rates charged by the lenders that finance mortgages on their balance sheets (portfolio lenders) and the interest rates charged by the originate-to-distribute lenders (OTD lenders) is positively associated with the levels of market concentrations (RHS figure).

[3] The Online Payday Loan Premium, with Filipe Correia and Jialan Wang

Abstract: Using data from a subprime credit bureau with nationwide coverage in the United States, we investigate the potential for online technology to lower fixed costs and increase lending efficiency in the expensive payday loan market. We find that prices for online loans are about 100 percentage points higher than storefront loans. Customers with both types of loans are much more likely to default on online loans, and pay higher prices on them. This premium is not explained by loan or customer characteristics, differences in pricing models, or traditional measures of credit risk. While part of the online payday loan premium seems to be associated with default rates that are double that for storefront loans, we show that information asymmetry explains this equilibrium.

Presentations: Eastern Finance Association 2024, Southern Finance Association 2023, Southern Economics Association 2023, 2023 CEAR-RSI Household Finance Workshop, Fintech for Inclusivity, Growth, and the Future 2023, Economics of Financial Technology Conference, 7th International Young Scholars’ Conference, 2022 American Economic Association, University of Illinois at Urbana-Champaign

Works-in-Progress

[1] How does Monetary Policy Impact the Valuation of Cryptocurrencies

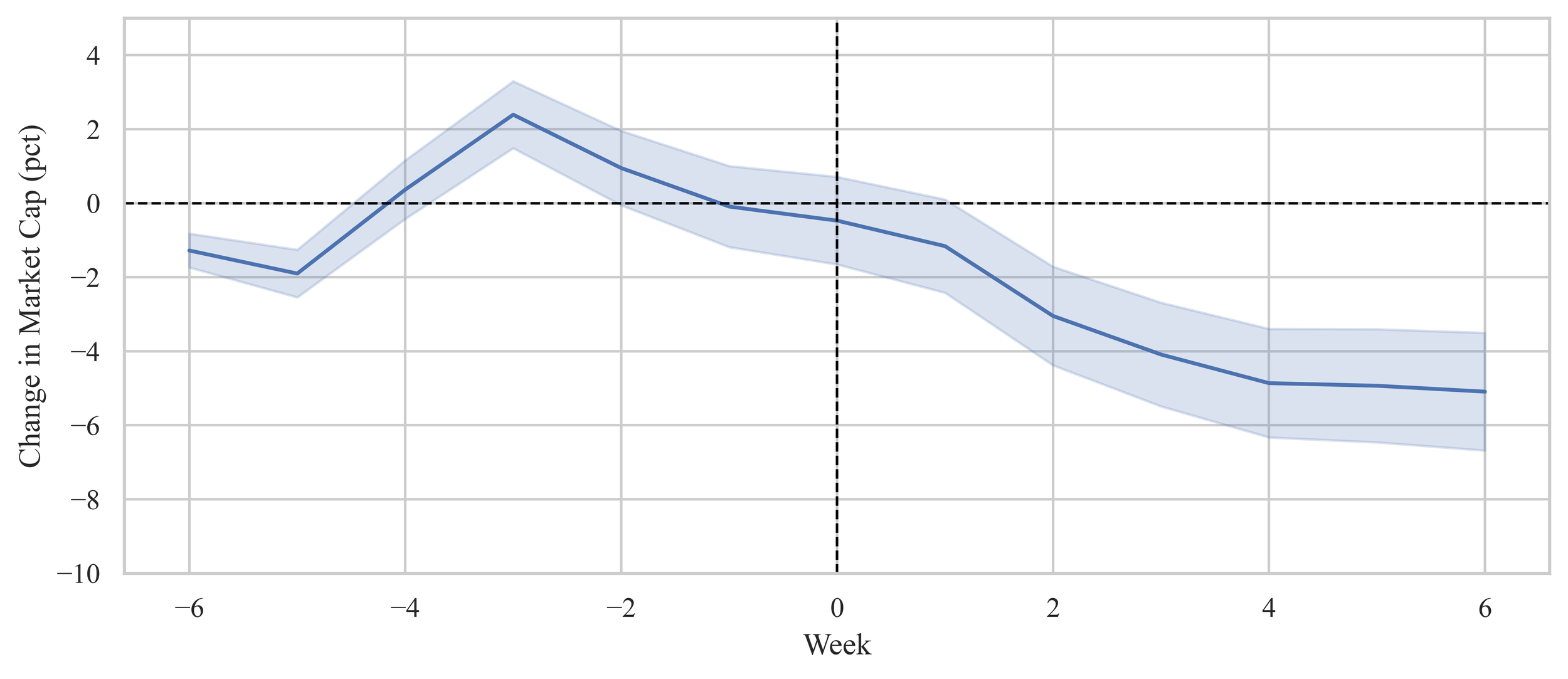

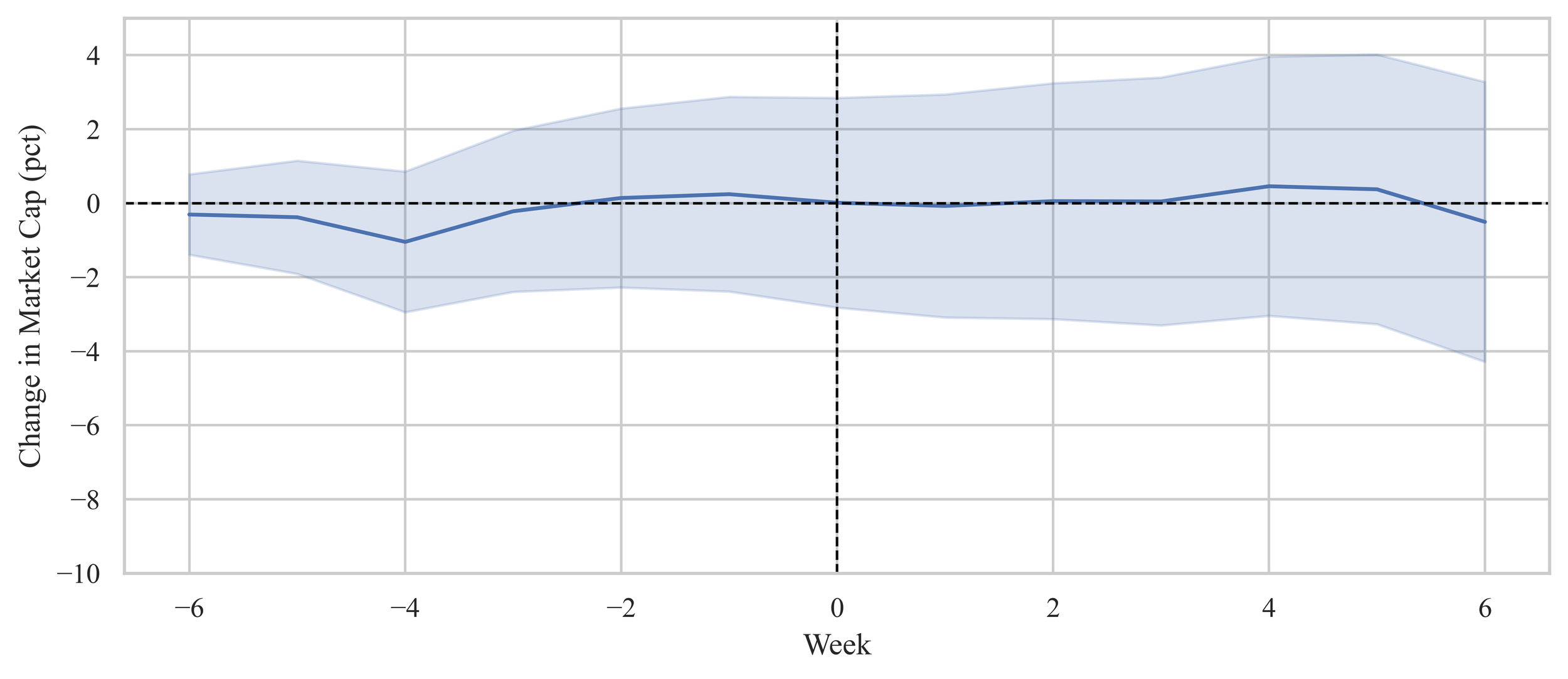

Summary: I study how monetary policy shocks affect the market capitalization of different categories of cryptocurrencies. I estimate that monetary tightening during 2021 and 2022 is responsible for about two-thirds of the drop in the valuation of the top 100 cryptocurrencies. In addition, the effect is stronger for smart contract tokens, such as Ethereum or Solana.

[2] Does Credit Market Structure Matter for Monetary Policy Transmission?, with Elizaveta Sizova

[3] Who Captures the Fed: Heterogeneous Response of Monetary Policy

Market capitalization response to monetary policy shocks by smart contract platform tokens (e.g. Ethereum, Solana)

Market capitalization response to monetary policy shocks by stablecoins (e.g. USDC)